BANK REFERENCE Information (mentions) about the bank in which the company has an account, transferred to another company as information for researching its creditworthiness. Before opening accounts, banks usually investigate the nature of the business, capabilities and finances. responsibility of their clients, and by maintaining constant contacts, they can express their opinions to others regarding the state of affairs of their clients. Such mutual exchange of information on a loan between banks is not a function that can be taken lightly, since it is not only about providing meaningful information on the loan, but also in liability for possible erroneous information. Every bank credit analyst should be familiar with Robert Morris Associates' Code of Ethics for loan inquiries, which was first adopted in 1916 and has been revised several times since.

View value Reference Banking in other dictionaries

Reference- references, w. (French rеfеrence). Recommendation, review of someone or something. (official, special). I am attaching references to my application. Provide references from previous places of work. || Reference........

Ushakov's Explanatory Dictionary

Reference- -And; and. [lat. referre - report]

1. Characteristics, feedback about the business qualities and financial capabilities of a person or enterprise, given by another person or enterprise.

2.........

Kuznetsov's Explanatory Dictionary

Bank Issued Guarantee— The issued guarantee can be confirmed in full or in part by another bank or other non-bank financial institution (confirmed guarantee).......

Legal dictionary

Bank Guarantee— - one of the ways to secure obligations. According to the civil legislation of the Russian Federation, by virtue of the B. g., a bank, other credit institution or insurance organization (guarantor) gives........

Legal dictionary

Bank Guarantee (Bank Letter of Guarantee)— is the obligation of the guarantor bank to pay, at the request of the beneficiary, a certain amount of funds on the terms agreed upon in the guarantee. ("Instructions on banking operations........

Legal dictionary

Bank Guarantee Upon First Demand— A guarantee on first demand means the obligation of the guarantor to make payment upon the first written demand of the beneficiary, drawn up in accordance with......

Legal dictionary

Banking Activities— - all types of activities (operations), the implementation of which is in accordance with the direct imperative requirements of federal legislation and regulations......

Legal dictionary

Banking Activities Illegal— - a crime in the field of economic activity, provided for in Art. 172 of the Criminal Code of the Russian Federation and representing 1) carrying out banking activities (banking operations)........

Legal dictionary

Bank Card (card)— a tool for drawing up settlement and other documents payable at the client’s expense.

Legal dictionary

Bank Card— - a credit card issued by a bank.

Legal dictionary

Banking Commission— - commission payments to the bank for carrying out banking operations in the interests of its client.

Legal dictionary

Bank Liquidity— - the bank’s ability to repay obligations on time, determined by the ratio and structure of the bank’s assets and liabilities.

Legal dictionary

Bank Margin— - the difference between credit and deposit interest rates, between credit rates for individual borrowers, between interest rates on active and passive operations.

Legal dictionary

Banking Dream- (slang) - economic zone. in which tax and foreign exchange laws relating to banking activities are flexible or extremely liberal. Examples.......

Legal dictionary

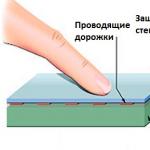

Bank Plastic Card— - a document issued to a client by a bank and used for identification when purchasing goods non-cash in stores or receiving cash. The basis of the calculations........

Legal dictionary

Banking Practice— - 1) activities of banks. It is used in this meaning in the Civil Code of the Russian Federation, when the business customs used in banking law are mentioned as a source of banking law;......

Legal dictionary

Banking Provisions— - in Western countries, a type of commission received by banks for participating in the placement of government loans. Acting as an intermediary commission agent, the bank........

Legal dictionary

Bank Savings Book to Bearer— A bearer bank savings book is understood as a savings book for which the right to receive a deposit, as well as interest on this deposit, has......

Legal dictionary

Banking System- - a set of different types of national banks, banking institutions and credit institutions operating in a particular country within the framework of the general monetary......

Legal dictionary

Banking System of the Republic of Belarus — Banking system Republic of Belarus - component financial and credit system of the Republic of Belarus. The banking system of the Republic of Belarus is two-tier.........

Legal dictionary

Banking System of the Russian Federation— The banking system of the Russian Federation includes the Bank of Russia, credit organizations, as well as branches and representative offices of foreign banks. Law of the RSFSR dated........

Legal dictionary

Bank Loan- - sum cash provided to an enterprise by a bank as a loan.

Legal dictionary

Bank Rate— - the amount of the bank’s loan interest, which is paid to it for the use of credit resources.

Legal dictionary

Banking Statistics— - a branch of socio-economic statistics, the tasks of which are to obtain information to characterize the functions performed by banks, develop analytical materials........

Legal dictionary

Banking Secrecy— - a special institution of civil law that protects the trade secrets of banks and their clients - legal entities and personal privacy of investors. According to Art. 857 of the Civil Code of the Russian Federation, the bank guarantees........

Legal dictionary

Bank Draft- - a bill of exchange, where the drawer and payer are the same bank. B.t. is a payment instrument that is close to cash in terms of liquidity.........

Legal dictionary

Bank Conditional Guarantee— A conditional guarantee means the obligation of the guarantor to make payment in accordance with the terms of the guarantee upon the written request of the beneficiary, accompanied by......

Legal dictionary

Bank Holding Company— - a joint-stock company that owns a controlling stake in legally independent banks and non-banking firms is created with the aim of exercising control over their......

Legal dictionary

Banking School— - the theory of emission, according to which the role of banks is to satisfy the need for funds, and the issue of these funds is limited automatically......

Legal dictionary

Bank guarantee— - see Bank guarantee.

Legal dictionary

(a situation where a client calls the banker's name as a reference; that is, for example, a supplier who deals with this client can, through its channels, request information about the bank's creditworthiness) banker's reference, bank reference, bank references Russian-English economic dictionary. Russian-English economics dictionary.

2001 More meanings of the word and translation of BANKING REFERENCES from English into Russian in English-Russian dictionaries. Translation of BANKING REFERENCES from Russian into English in Russian-English dictionaries.

Large Russian-English Dictionary BANKING - Bank Russian Learner’s Dictionary BANKING - BANKING SYSTEMS Commercial banks.

What is a bank reference, and does such a document exist?

Fraudsters offer to establish contractual relations in a short time and with minimal investment, and, most importantly, in absentia, i.e.

e. without the actual presence of representatives of partner companies, through email correspondence. What kind of document do scammers have in mind, and how to distinguish a real offer of cooperation from a fake one, you will learn from this article.

Based on the fact that the word “reference” itself, in accordance with the modern economic dictionary, means “the provision of a recommendation, a characteristic by one person (organization) to another person (organization) in order to confirm that he (she) enjoys trust in business circles” , in correlation with the adjective “banking”, this concept can mean “certification of the creditworthiness and solvency” of the client.

Russian-English translation BANK REFERENCES (a situation where a client calls the banker's name as a reference; that is, for example, a supplier who deals with this client can, through its channels, request information about the bank's creditworthiness) banker's reference, bank reference, bank references Russian-English economic dictionary.

Source: http://advokat-bondarev.ru/referens-banka-chto-ehto-59533/

Employment Reference Letter. Examples

It is incorrect to talk about a “template” for a Reference Letter, because only a document for which there is a standard can have a template. Reference letters are written in a free style, so there should not be two identical Reference letters.

I described the basic requirements for letters in a separate article - “Immigration to Canada. Confirmation of work experience. How to write a Reference letter."

In this same article, I will show several examples found on the Internet of how people designed a Reference Letter and several of their own

I strongly recommend composing a Reference letter yourself, rather than using templates and examples from the Internet. Most often, if a template appears on the Internet, everyone starts writing the same way, and 10 identical reference letters on the visa officer’s desk from different people will raise questions and increase the chance of additional checks.

Some of my Reference

I decided for myself that my References will be made in the form of certificates from work, and in no case do I claim that this path is correct. I'm just showing examples of how I formatted my Reference Letters. Below I give examples of how other people on the Internet design Reference, which is completely different from my approach.

Example 1. Document in Russian. Certificate from work.

Example 2. Document in Russian. Certificate of employment (supplemented by an extract from the job description).

Reference from the Internet and WhatsApp chats:

Example 1. Real references from whatsapp chat.

- from a colleague

- from the immediate supervisor

Source: https://julik.space/2016/09/10/employment-reference-examples/

What does reference mean in the subject line of an email?

A letter arrived in the mail, and in the subject of the letter there was a word that was unfamiliar to me. What would that mean?

The word “reference” appears quite often on the Internet. This is an English word and the literal translation is: footnote, reference

For example, the reference of the hero presented in some description is his photograph.

List of references, there is also such an expression - these are materials (photos, links) attached to the material.

In other words, it can be a footnote, a callout (explaining details), or cross-references.

Or a reference sheet, this is a copy of the document that confirms the text.

In Russian it can be said more simply - a document accompanying the material (or article).

HOLD - what is it and “what is it eaten with”?

Accordingly, if the file arrives after the hold is removed, the amount will be debited.

This is fraught with a “technical overdraft” (simply a negative balance), but, fortunately, it happens very rarely. Unfortunately, we cannot influence the timing of appropriate actions on the part of a third-party bank.

In combination with Nuance No. 1, a situation may occur when the write-off occurred on the “new” account, and the hold remained hanging on the “old” account.

It will not be possible to remove the hold before the deadline at your request - no matter how you ask and what documents from point of sale or the bank servicing it, do not send it.

Attention!

Although there may be some nuances here too - depending on the rules of the acquiring bank or the terminal settings.

Android Select language Current version v.226

per month, (_____________________) tons, (cubic meters) per year according to the Irrevocable confirmed order No. _______ dated “_____” __________ 2010, the bank will make payment for the goods in accordance with the payment terms accepted in the Contract. * If the company is financed by a bank, then the content of the last paragraph is as follows: When concluding a contract between __________________ and _________________________

per month, (_____________________) tons, (cubic meters) per year according to the Irrevocable confirmed order No. _______ dated “_____” __________ 2010, the bank will make payment for the goods in accordance with the payment terms accepted in the Contract.

* If the company is financed by a bank, then the content of the last paragraph is as follows: When concluding a contract between __________________ and _________________________

Instructions for generating and sending salary slips through the on-line service Privat 24 (Internet Client-Bank)

To create a statement without a payment reference, uncheck the “Add” box and click “Create”: If the payment reference is known, indicate it in the “Payment reference” field, check the “Add” box and click the “Create” button Step 3. Filling out the statement NEW After By clicking the “Create” button, an empty statement is generated, which is assigned a unique identification number (to view all created statements, go to the “Statement Log” menu).

Economic dictionary

Bank Commission is a commission paid to a bank for carrying out banking operations in the interests of its client.

Bank Liquidity is the bank’s ability to repay obligations on time, determined by the ratio and structure of the bank’s assets and liabilities.

Bank Margin is the difference between credit and deposit interest rates, between credit rates for individual borrowers, between interest rates on active and passive operations.

Banking Dream - (slang) - economic zone.

What is a bank reference, and does such a document exist? — All about money in Russia

The concept of “bank reference” (identical to it as “bank reference”) is currently not regulated by law, therefore it is not contained in any regulatory legal act of the Russian Federation.

If you are looking for an answer to this question Most likely, you have encountered one of the document fraud schemes.

Most often, this concept is used in the context of dubious business proposals that contain promises from intermediary organizations to organize cooperation with a well-known company on an advance payment, guaranteeing bright prospects for business development.

Fraudsters offer to establish contractual relations in a short time and with minimal investments, and, most importantly, in absentia, that is, without the actual presence of representatives of partner companies, through electronic correspondence.

At the same time, they operate with names and contact information well-known enterprises (for example, PJSC NK Rosneft or its subsidiaries) down to the personal data of managers and, to create the illusion of their affiliation with them, provide links to the official resources of these organizations. The letter is usually accompanied by a draft contract (a sample application for the purchase of goods, ICPO) along with a sample “bank reference”.

What kind of document do scammers have in mind, and how to distinguish a real offer of cooperation from a fake one, you will learn from this article.

“Banking reference”: revealing the concept

Based on the fact that the word “reference” itself, in accordance with the modern economic dictionary, means “the provision of a recommendation, a characteristic by one person (organization) to another person (organization) in order to confirm that he (she) enjoys trust in business circles” , in correlation with the adjective “banking”, this concept can mean “certification of the creditworthiness and solvency” of the client. In other words, this is a regular letter of recommendation and review.

In reality, such a concept and, in particular, a document does not exist.

In accordance with Article 26 Federal Law“On banks and banking activities” under number 395-1, credit organizations and their employees are obliged to keep secrets related to the accounts, deposits and transactions of their clients (correspondents) and can provide it exclusively to themselves or to a very limited circle of organizations (tax authorities, PFR and FSS of the Russian Federation, courts, etc.).

Therefore, if in nature there is a “bank reference” certified by the signature of a bank employee and the seal of a credit institution, then this is either a simple “fiction” or a violation of the bank employee’s duties, which inevitably entails the latter’s dismissal.

What other imaginary documents and concepts can scammers use?

Other phrases most often used by scammers in their “business” letters can also lead to complete confusion.

Namely:

- “irrevocable confirmed order or application, abbr. BPZ” – not a single serious supplier (processor) has this form of document. Moreover, no one can deprive you of the right to refuse an order even before the counterparties actually sign an additional agreement to the supply agreement and require the approval of the supply application by a credit institution;

- “bank officer” - most likely, the expression is borrowed from English language(“bank officer”) and literally means “bank official”;

- “non-disclosure agreement, abbr. NCNDA” is another “tracing copy” from English, which is presumably taken from a translation of a contract on a similar topic.

In addition, there may be such cumbersome, awkward phrases as “direct debit of funds”, “full corporate guarantee of payment”, “SWIFT and CUSIP numbers”, etc., the meaning of which is difficult to establish, even when compared with full text letters.

Remember: no organization will establish contractual relations in absentia, conduct correspondence via the Internet or provide any guarantees to counterparties based on documents sent by email.

The transaction parameters offered by scammers differ significantly from the market ones and indicate an unreasonably large profit.

First of all, you should be wary of the requirement to transfer a certain amount allegedly in payment for certain services, for example, for the preparation of documents, including permits, invitations, visas, etc., or the activation (legalization) of an agreement in Russian ministries or government departments (such the procedure cannot, in principle, be provided for by law).

You may also be asked to pay for transportation, services related to organizing a trip to the Moscow office of a company with which they are in imaginary cooperation, to sign a contract, etc. All this is nothing more than a fiction that scammers resort to to make money .

If you receive such commercial offers from false intermediary companies and you have any doubts about the validity of the promised transactions, we recommend contacting law enforcement agencies.

Source: http://rudengi.com/banki/referentsiya-banka-sushhestvuet-li.html

Economic Dictionary - meaning of the word Reference Banking

BANK REFERENCE Information (mentions) about the bank in which the company has an account, transferred to another company as information for researching its creditworthiness. Before opening accounts, banks usually investigate the nature of the business, capabilities and finances.

responsibility of their clients, and by maintaining constant contacts, they can express their opinions to others regarding the state of affairs of their clients. Such mutual exchange of information on a loan between banks is not a function that can be taken lightly, because

is not only to provide meaningful information on the loan, but also to take responsibility for possible erroneous information.

Every bank credit analyst should be familiar with Robert Morris Associates' Code of Ethics for loan inquiries, which was first adopted in 1916 and has been revised several times since.

View value Reference Banking in other dictionaries

Reference- references, w. (French rеfеrence). Recommendation, review of someone or something. (official, special). I am attaching references to my application. Provide references from previous places of work. || Reference……..

Ushakov's Explanatory Dictionary

Reference- -And; and. [lat. referre - report]1. Characteristics, feedback about the business qualities and financial capabilities of a person or enterprise, given by another person or enterprise.2………

Kuznetsov's Explanatory Dictionary

Bank Issued Guarantee- The issued guarantee can be confirmed in full or in part by another bank or other non-bank financial institution (confirmed guarantee)………

Legal dictionary

Bank Guarantee- is one of the ways to secure obligations. According to the civil legislation of the Russian Federation, by virtue of the B. g., a bank, other credit institution or insurance organization (guarantor) gives……..

Legal dictionary

Bank Guarantee (Bank Letter of Guarantee)- is the obligation of the guarantor bank to pay, at the request of the beneficiary, a certain amount of funds on the terms agreed upon in the guarantee. (“Instructions on banking operations……..

Legal dictionary

Bank Guarantee Upon First Demand- A guarantee on first demand means the obligation of the guarantor to make payment upon the first written demand of the beneficiary, drawn up in accordance with……..

Legal dictionary

Banking Activities- - all types of activities (operations), the implementation of which is in accordance with the direct imperative requirements of federal legislation and regulations……..

Legal dictionary

Banking Activities Illegal- - a crime in the field of economic activity, provided for in Art. 172 of the Criminal Code of the Russian Federation and representing 1) carrying out banking activities (banking operations)……..

Legal dictionary

Bank Card(map)- a tool for drawing up settlement and other documents payable at the client’s expense.

Legal dictionary

Bank Card- - a credit card issued by a bank.

Legal dictionary

Banking Commission- - commission payments to the bank for carrying out banking operations in the interests of its client.

Legal dictionary

Bank Liquidity- — the bank’s ability to repay obligations on time, determined by the ratio and structure of the bank’s assets and liabilities.

Legal dictionary

Bank Margin- — the difference between credit and deposit interest rates, between credit rates for individual borrowers, between interest rates on active and passive operations.

Legal dictionary

Banking Dream- (slang) - economic zone. in which tax and foreign exchange laws relating to banking activities are flexible or extremely liberal. Examples……..

Legal dictionary

Bank Plastic Card- - a document issued to the client by the bank and used for identification when purchasing goods non-cash in stores or receiving cash. The basis of the calculations……..

Legal dictionary

Banking Practice- — 1) activities of banks. This meaning is used in the Civil Code of the Russian Federation, when business customs used in banking law are mentioned as a source of banking law;……..

Legal dictionary

Banking Provisions- - in Western countries, a type of commission received by banks for participating in the placement of government loans. Acting as an intermediary commission agent, the bank……..

Legal dictionary

Bank Savings Book to Bearer- A bearer bank savings book is understood as a savings book for which the right to receive a deposit, as well as interest on this deposit, has……..

Legal dictionary

Banking System- - a set of different types of national banks, banking institutions and credit institutions operating in a particular country within the framework of the general monetary……..

Legal dictionary

Banking System of the Republic of Belarus- The banking system of the Republic of Belarus is an integral part of the financial and credit system of the Republic of Belarus. The banking system of the Republic of Belarus is two-tier........

Legal dictionary

Banking System of the Russian Federation- The banking system of the Russian Federation includes the Bank of Russia, credit organizations, as well as branches and representative offices of foreign banks. Law of the RSFSR dated……..

Legal dictionary

Bank Loan- - the amount of money provided to an enterprise by a bank as a loan.

Legal dictionary

Bank Rate- is the amount of the bank’s loan interest, which is paid to it for the use of credit resources.

Legal dictionary

Banking Statistics- - a branch of socio-economic statistics, the tasks of which are to obtain information to characterize the functions performed by banks, develop analytical materials........

Legal dictionary

Banking Secrecy- is a special institution of civil law that protects the trade secrets of banks, their clients - legal entities and the personal secrets of depositors. According to Art. 857 of the Civil Code of the Russian Federation, the bank guarantees……..

Legal dictionary

Bank Draft- - a bill of exchange, where the drawer and payer are the same bank. Banknote is a payment instrument that is close to cash in terms of liquidity………

Legal dictionary

Bank Conditional Guarantee- A conditional guarantee means the obligation of the guarantor to make payment in accordance with the terms of the guarantee upon the written request of the beneficiary, accompanied by……..

Legal dictionary

Bank Holding Company- - a joint stock company that owns a controlling stake in legally independent banks and non-banking firms is created for the purpose of exercising control over their……..

Legal dictionary

Banking School- - the theory of emission, according to which the role of banks is to satisfy the need for funds, and the issue of these funds is limited automatically........

Legal dictionary

Bank guarantee- - see Bank guarantee.

Legal dictionary

Instructions for generating and sending salary slips via

on-line service PRIVAT 24 (Internet Client-Bank)

On-line service allows you to:

1. Enter the statement manually -for this you need to know your personnel number

employee and the amount that he needs to credit to the card

2. Import the statement file in *xls or *dbf format.

A mandatory requirement is that the files must comply with a certain structure.

3. Monitor the stages of statement processing in the Bank.

4. Print the statement with a note from the Bank about its processing.

Preparing statements manually

(mainly used for preparing small statements)

Step 1. Select a salary project

You need to go to the Privat24 menu " Cards – Salary - Create a statement»

and select an available salary project:

Step 2. Add the payment reference to the statement

Payment reference is the payment number to the bank's transit account (2924*05*******), which is used for subsequent crediting of funds to cards. The account number must be indicated in the contract.

To add a payment to the statement you must:

Check the box " Add»

Click the “Search” button.

From the displayed list of payments you need to select the desired amount and press the button

« Create».

Attention!!!Payments are searched for a periodLast 3 calendar days . If the payment was made earlier, you need to contact the department servicing the salary project with a request to update the payment reference.

In cases where at the time of generating the statement, the payment has not yet been made (has not been updated), it can be added to the statement later:

At the stage of adding employees to the list

At any convenient time, through the menu " Statement journal»

To create a statement without a payment reference – uncheck the box « Add" and click " Create»:

If the payment reference is known, indicate it in the field " Payment reference», check the box « Add" and press the button " Create»

Step 3. Filling out the form NEW

After pressing the button " Create» an empty statement is generated, which is assigned a unique identification number (to view all created statements, go to the “Statement Log” menu).

Adding employees to the payroll is carried out through:

Search by personnel number / card number

Using the button " List of employees» NEW

First way.

Adding employees by personnel number / card number

Fill in the employee's personnel number or card number and click " Search».

Fill in the field "Sum" card replenishment, edit the field " if necessaryPurpose of payment " and click " Add»:

As a result, the card will be added and saved in the statement:

To add the next employee to the list, repeat the search and addition procedure. If you add an employee by mistake, you can remove him by clicking on the " Delete»

Second way.

Adding employees via the “List of Employees” button

When you click it, a list of all employees of the salary project who have open salary cards in this project will be provided.

We select employees. Fill in the field "Sum" replenish the card, if necessary, edit the field "Purpose of payment »

If everything is specified correctly, the card will automatically be added and saved to the payroll.

If the field is filled in incorrectly " Sum» the program will warn you with a sign

Step 4. Checking the statement for errors

After adding all the necessary employees to the list, we send the list for verification.

Based on the results of the check, two situations are possible:

The statement has been verified and is awaiting approval.

The statement has been checked with errors and is awaiting correction.

There are two types of errors:

The amount on the statement is greater than the payment amount

The statement contains cards for which enrollment is not possible

To eliminate these errors, you need to edit the statement:

Delete entries with erroneous amounts and/or time sheets;

Add entries with correct amounts and/or time sheets

After correcting errors, the statement must be sent for verification again.

Step 5. Statement approval

After the statement is checked without errors, the “check” button changes to “approve”:

Important!After approval, the statement is not available for editing; it can either be sent to

bank or delete.

After successful approval, the following message is displayed:

and the menu for signing statements opens. From the list of unsigned statements, select

the one you need and put an electronic digital signature(EDS):

After applying an electronic digital signature to the statement:

it becomes available for sending to the bank for crediting:

Important! All approved/signed statements are stored in the statement log. Search

carried out using the “Status - approved” filter.

Generating a statement using the file import function

Step 1. Preparing the statement file

The service allows you to import statement files in *xls or *dbf format, which correspond

following structure:

* Requirements for the structure of files in *dbf format

A statement file template (in *xls or *dbf format) can be obtained from the bank branch servicing the salary project - contact the manager.

Step 2. Load the list file import menu

Importing the statement is available both in the main menu:

and in the list creation menu:

When you call the import menu, the JAVA application is activated:

Step 3. Select the list file to import

In the “File” menu, select the file format to import, and also indicate the location of the file:

After selecting the file, you will be asked to enter the Privat24 username and password, you need

enter this data and click the button " OK»:

Users who are additionally verified using a one-time password will have

request to select a number mobile phone and enter the received password.

If the entered login and password are correct and the file does not contain errors, the import process will begin

entries from the file to the statement:

After complete downloading of information from the file, a message about the quantity will be displayed

imported records and statement total:

Step 4. Preparing the statement for sending for enrollment

To send the imported statement to the bank for crediting, you need to go to the statement journal:

display created statements:

and select the last one created from the list (click on the statement ID):

Further operations with the statement are the same as withmanually creating a statement :

Add a payment reference to the statement and check (Step – 4)

Approve, sign and send the statement to the bank for crediting to the cards (Step – 5)

Tracking the stages of statement processing in the Bank

To check the status of the statement sent for enrollment, go to the journal

and download the sent statements for the required period:

The current status of the statement will be reflected:

Sent statements can acquire the following statuses:

Processed – funds sent to cards

On enrollment (processing) - the statement is awaiting distribution to cards in accordance with the regulations:

Printing a statement with a note from the Bank about its processing.

To print the processed statement, click onStatement ID:

In the statement that opens, select " Seal»:

Not only liquid products are frozen, but also money. Yes, yes, it is this word that most clearly characterizes the state in which your hard-earned money is when, instead of the payment reference in the statement in Alfa-Click, you see the mysterious word HOLD.

Hold (HOLD)– this is a temporary reservation of the amount of a card transaction until the transaction is confirmed or there is no confirmation within the period established by the bank.

In other words, at the time of payment for the purchase, money is not debited from the card account, but is held—temporarily “frozen.” The actual write-off occurs later - after processing special clearing files.

Let's look at an example. The client pays in the store with an Alfa-Bank card with a balance of 5,000 rubles for the amount of 1,000 rubles. When the card interacts with the store terminal, authorization occurs: through payment system A request is sent to Alfa-Bank: 1) does a card with such details exist and is it active? 2) do you have the required 1000 rubles on your card account? After receiving a positive answer to these questions (approval) from the bank, the operation is carried out.

At this moment, 1000 rubles are reserved in the client’s account for subsequent debiting. If there is an Alfa-Check, the client is sent an SMS message about the debiting of this amount from the account, the available balance on the account in the balance sheet and in the Internet bank is displayed minus it, that is, 4,000 rubles.

However, in reality, only half the work is done. Now the bank servicing the terminal must send so-called clearing files to Alfa-Bank (again through the payment system), on the basis of which the actual write-off will occur. After receiving and processing the data, the data is uploaded to the bank’s system, 1000 rubles are actually debited from the account, and the operation is marked as completed. The Hold ceases to exist.

Of course, the whole process is more complicated and full of “if this, then like this” options, but for a general understanding all the details are not needed.

"Lifespan" of the hold at Alfa-Bank it is set on the basis of statistical data - based on the time during which the vast majority of transactions are actually written off.

For a long time it was 14 days, but in 2012 the period was reduced to 9 days. The reason for this was the requests of clients who found themselves in a position where it is already known for sure that the operation will not be carried out (when returning or canceling a purchase, for example), but it is also impossible to use the money, since it is frozen.

In most cases, operations are successful within the general time frame, so after the purchase the client lives quietly, unaware of all this “movement” between terminals, payment systems, banks and parts of their internal systems.

But sometimes they happen...

Nuance No. 1: When files are received for debiting, according to the rules of payment systems, the bank is obliged to debit using the details specified in these files.

Accordingly, if the file arrives after the hold is removed, the amount will be debited. This is fraught with a “technical overdraft” (simply a negative balance), but, fortunately, it happens very rarely. Unfortunately, we cannot influence the timing of appropriate actions on the part of a third-party bank.

The other side of the situation is when the authorization details and the received confirmation do not match. Sometimes banks “sin” with a unique approach to the formation of files, and therefore the Alfa-Bank system cannot link them with the required holding. As a result, the client’s account is debited, and the hold remains hanging. The problem is rare, but it can be treated the same way - only with time.

In combination with Nuance No. 1, a situation may occur when the write-off occurred on the “new” account, and the hold remained hanging on the “old” account.

Nuance No. 3: If the transaction currency is different from the account currency, then it is not uncommon for one amount to be held while another is actually written off.

It’s simple: at the time of authorization one conversion rate is in effect, and a few days later (at the time the transaction is processed) another one is in effect. The conversion is applied at the rate on the day of write-off, and since the timing of this process is beyond our control, we cannot predict the rate at which the write-off will occur. As they say, production costs.

Nuance No. 4: We cannot speed up the defrosting process.

The concept of “bank reference” (identical to it as “bank reference”) is currently not regulated by law, therefore it is not contained in any regulatory legal act of the Russian Federation. If you are looking for an answer to this question, most likely you have encountered one of the document fraud schemes. Most often, this concept is used in the context of dubious business proposals that contain promises from intermediary organizations to organize cooperation with a well-known company on an advance payment, guaranteeing bright prospects for business development.

Fraudsters offer to establish contractual relations in a short time and with minimal investments, and, most importantly, in absentia, that is, without the actual presence of representatives of partner companies, through electronic correspondence.

At the same time, they operate with the names and contact information of well-known enterprises (for example, PJSC NK Rosneft or its subsidiaries) down to the personal data of managers and, to create the illusion of their affiliation with them, provide links to the official resources of these organizations. The letter is usually accompanied by a draft contract (a sample application for the purchase of goods, ICPO) along with a sample “bank reference”.

What kind of document do scammers have in mind, and how to distinguish a real offer of cooperation from a fake one, you will learn from this article.

“Banking reference”: revealing the concept

Based on the fact that the word “reference” itself, in accordance with the modern economic dictionary, means “the provision of a recommendation, a characteristic by one person (organization) to another person (organization) in order to confirm that he (she) enjoys trust in business circles” , in correlation with the adjective “banking”, this concept can mean “certification of the creditworthiness and solvency” of the client. In other words, this is a regular letter of recommendation and review.

In reality, such a concept and, in particular, a document does not exist. In accordance with Article 26 of the Federal Law “On Banks and Banking Activities” No. 395-1, credit institutions and their employees are required to keep secrets related to the accounts, deposits and transactions of their clients (correspondents) and can provide it exclusively to themselves or to a very limited circle of organizations (tax authorities, the Pension Fund of the Russian Federation and the Federal Tax Service of the Russian Federation, courts, etc.).

Therefore, if in nature there is a “bank reference” certified by the signature of a bank employee and the seal of a credit institution, then this is either a simple “fiction” or a violation of the bank employee’s duties, which inevitably entails the latter’s dismissal.

What other imaginary documents and concepts can scammers use?

Other phrases most often used by scammers in their “business” letters can also lead to complete confusion.

Namely:

- “irrevocable confirmed order or application, abbr. BPZ” – not a single serious supplier (processor) has this form of document. Moreover, no one can deprive you of the right to refuse an order even before the counterparties actually sign an additional agreement to the supply agreement and require the approval of the supply application by a credit institution;

- “bank officer” - most likely, the expression is borrowed from the English language (“bank officer”) and literally means “bank official”;

- “non-disclosure agreement, abbr. NCNDA” is another “tracing copy” from English, which is presumably taken from a translation of a contract on a similar topic.

In addition, there may be such cumbersome, awkward phrases as “direct debit of funds”, “full corporate guarantee of payment”, “SWIFT and CUSIP numbers”, etc., the meaning of which is difficult to establish, even when compared with the full text of the letter .

Remember: no organization will establish contractual relations in absentia, conduct correspondence via the Internet or provide any guarantees to counterparties based on documents sent by email.

The transaction parameters offered by scammers differ significantly from the market ones and indicate an unreasonably large profit.

First of all, you should be wary of the requirement to transfer a certain amount allegedly in payment for certain services, for example, for the preparation of documents, including permits, invitations, visas, etc., or the activation (legalization) of an agreement in Russian ministries or government departments (such the procedure cannot, in principle, be provided for by law).

You may also be asked to pay for transportation, services related to organizing a trip to the Moscow office of a company with which they are in imaginary cooperation, to sign a contract, etc. All this is nothing more than a fiction that scammers resort to to make money .

If you receive such commercial offers from false intermediary companies and you have any doubts about the validity of the promised transactions, we recommend contacting law enforcement agencies.

What is reference number?

What is a Reference in working with bank accounts? and got the best answer

Answer from Alexander[guru]A bank reference is a letter from a bank containing information about a person as a client of this bank who has no violations of banking discipline. And when working with bank accounts, I think this is a statement of the bank account, if any, about its condition, amount and etc. Where did you find such a concept? Is it by chance not on the list of documents for obtaining a visa?