Software tool for the preparation of information on the income of individuals in the form 2-NDFL for 2018, a certificate of the average headcount, declaration of all taxes, the balance sheet of the enterprise.

A software tool in terms of automating the process of preparation by a taxpayer of forms of documents for tax and accounting reporting, documents used in accounting for taxpayers, when submitting to the tax authorities.

Often the program is used to create files with information about the income of the individual entrepreneur for 2018 and test them for compliance with the Order of the Federal Tax Service of Russia No. SAE-3-04 / [email protected] of 13.10.2006 "On approval of the form of information on the income of individuals" (registration with the Ministry of Justice of the Russian Federation on November 17, 2006, No. 8507, taking into account the changes introduced by the Order of the Federal Tax Service of Russia dated December 30, 2008 No. MM-3-3 / [email protected]"On Amendments to the Order of the Federal Tax Service of Russia dated 13.10.2006 No. SAE-3-04 / [email protected]", Registered in the Ministry of Justice of the Russian Federation No. 13101 of 19.01.2009).

Version 4.60 of the program for automating the process of preparation by a taxpayer of forms of documents for tax and accounting reporting, documents used in registering taxpayers, when submitted to the tax authorities, is posted on the website of the State Scientific Research Center. A certificate of the average headcount, declarations of all taxes, and the balance sheet of the enterprise are being prepared.

The developers report that in new version included the forms of notifications of payers approved by the order of the Federal Tax Service of Russia ММВ-7-14 / [email protected] from 22.06.2015.

Free download "Taxpayer" (version 4.60) to fill in 2-NDFL, 6-NDFL, all tax DECLARATIONS and balance for 2018 - 2019

Note: from the website of the Federal Tax Service of the Russian Federation tax.ru (nalog.ru)

Download the program TAXPAYER YUL version 4.60

The set includes a program for filling and printing the BALANCE SHEET and the REPORT on Financial Results. Important! You need to download all program files, including additional changes! Move the slider down and view all the changes, if any, download them. For depositing the balance, the version is not lower than 4.60!

Download TESTER version 2.136 checking report files for tax

The set includes a program for checking files for compliance with presentation formats in in electronic format tax declarations, financial statements (Program "Tester" version 2.136). Before sending it to the tax reporting file, you need to check it with the latest version of the "Tester" program. If there are errors, then you need to download the latest version of the YUL TAXPAYER program. Otherwise, the tax office will not accept the file with the declaration or balance sheet.

| MORE RELATED LINKS |

-

Deadline for submitting reports for 2018-2019. The table of delivery of the balance sheet, tax reporting for organizations and individual entrepreneurs. When to submit the declaration 2018-2019 year, 1 quarter, half a year, 9 months. -

An example of filling out a 2-NDFL certificate is given. Descriptions of the help fields are provided. The link is given to download the 2-ndfl help form. -

New forms of 2-NDFL tax return are reported. Deadlines for delivery. Where to download for free. Taxpayer program. New format 2-NDFL.

Good afternoon dear friends! Today I want to tell you how to update the Legal entity taxpayer. This procedure is very important, the Federal Tax Service is constantly changing the forms and templates for reports. Therefore, if you do not update the program in a timely manner, then your report may simply not be accepted. You may have a correct report, but due to the fact that you have an old form, the tax office may simply reject the report. Let's get started!

How to update the Legal entity taxpayer

If you can't decide on your own this problem, then you can go to the section and our specialists will help you.

Now let's find out which version we have. We launch the program and see the version of the program in the header.

The version of the program is written after the words "Legal entity taxpayer". In this case, I have version 4.57. And the latest version is 4.57.1. So we need to update the Taxpayer.

How to install the version of Legal entity taxpayer correctly

Now very important point!!! In order for the update to be correct, the sequence of versions must be followed. The first step is to put the full version. Then, an additional version. The full version is always three digits long. In this case, these numbers are 4.57, the next full version will be 4.58, then 4.59, and so on. Additional versions are four digits long. For example, now we will install version 4.57.1, then it will be 4.57.2, then 4.57.3 and so on. It happens that there are no additional versions at all or, on the contrary, there are many. Recently there was such that there was version 4.56.6. That is, there may be many additional versions, or there may not be at all.

Now let's analyze which version to install on which. First of all, we always put full version, then additional. For example: you have version 4.56.3, and now the latest version is 4.57.1. So, first of all, we install version 4.57. Then we launch our "Legal entity taxpayer", the database is reindexed and only after that we install 4.57.1.

If you start installing version 4.57.1, and you have version 4.56.3, then the program "Taxpayer Legal Entity" will not be updated for you, or it will not be updated correctly!

Even if you have version 4.54.1 or 4.56, then a higher version, such as 4.57, can be installed safely. That is, the superior FULL version can be installed on ANY previous one.

Now let's deal with additional versions.

How to correctly install additional versions of Legal entity taxpayer

We will analyze everything again with examples. Now we are going to install version 4.57.1. In the future, version 4.57.2 will be released (or maybe not).

Let's assume we are currently running version 4.56.1. So we install first version 4.57, and then 4.57.1. But remember! After installing each version, you need to run the program so that the database is reindexed, only after reindexing can you update the program further.

Now let's look at another option. You have version 4.57, and the update is 4.57.3. In this case, you do not need to install versions 4.57.1 and 4.57.2, but immediately install version 4.57.3. All clear? If not, then the questions are in the comments.

Step-by-step instructions on how to update a Legal entity taxpayer

The theory is over! Now let's go directly to the update process!

I have version 4.57, the latest version is 4.57.1. Downloading Last update here . We unpack it. If you don't know how to unpack a file, then read my article here.

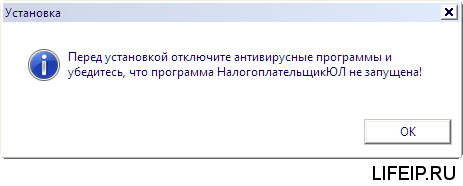

Now, be sure to close the LE taxpayer program. Make sure you close the program a hundred times. Otherwise, you will lose all your data!

We start the update. We see the "Greetings" window. Just click "Next".

Now is the most important step. We need to choose which folder to install the updates to. Click on the shortcut with the program right click mouse and select the item "File location".

A folder with Taxpayer will open. We look at the way. My Taxpayer is located along the path "C: \ NP YL \ INPUTDOC".

You may have another way! In the updater, we need to specify this path, only without the "INPUTDOC" folder. Here I have the path "C: \ NP YL \ INPUTDOC", so during the update process I specify the path "C: \ NP YL". After specifying the path, click "Next".

The update process will then begin. After the end of the update, a window like this will appear. Just click "Finish"

Immediately after the update, a window like this may appear. No need to panic, just click "This program is installed correctly".

Now we launch our Legal Entity Taxpayer and see the reindexing that I told you about. We just wait, without pressing anything, and without turning off the computer and the program, otherwise everything will break!

Now we look at the program header again to make sure that the update was correct and the latest version is installed.

We can see that I now have version 4.57.1. So the update went well and correctly!

If you need professional help system administrator, to resolve this or any other issue, go to the section, and our employees will help you.

Now you know how to update the Legal Entity Taxpayer.

If you have any questions, ask them in the comments! Good luck and good to everyone!

To be the first to receive all the news from our site!

Instructions

To update program entitled " Taxpayer», You need to connect to the Internet, since all updates take place by means of the software addressing the server with a request for new versions. If you still have not activated the Internet, open the "Network Neighborhood" tab. Select the connection type and right-click. IN context menu click the "Connect" button.

As soon as the Internet is working, you can start updating the program. Run this software by double-clicking on the shortcut on the computer desktop. The main menu of the utility will start. Click on "Help". Next, select the "Program update" tab and right-click. You will have to wait for a while until all files are updated in the program. As a rule, the download time depends on the speed of the Internet connection that you have connected.

There are other ways to update the program. Go to the official website of the developer. This can be done through the software menu or use search engines in the Internet. Find the "Downloads" item on the website. You can download all program entirely without deleting old version... Always use antivirus software when downloading, as malware can be in almost any file or archive.

Once the download is complete, run the exe format file. The utility will automatically install on your hard drive personal computer after replacing the old version. You can only install the update patch from the site. This significantly saves Internet traffic. However, it is worth noting that patches are often laid out unfinished, so it is best to use the update using the program itself.

Sources:

- updates for the program taxpayer yul 4

The 1C software developers release updates several times a year to bring your software into compliance with the law and eliminate errors that occur from time to time. By purchasing the program, you simultaneously get access to downloading files in the updates section of the website. If Internet access is limited, you can purchase a CD with the updated program at the company's office.

You will need

- - access to the Internet;

- - registered installed software "1C: Taxpayer";

- - a valid contract for information technology support (1C: ITS).

Instructions

The easiest way to update 1C: Taxpayer is to use the built-in update function. The program will download and install all the necessary files by itself. To do this, launch "1C: Taxpayer" and go to the "Help" section in the main menu of the program. Select "Software update" and wait for the download and installation to finish. Reboot your computer.

You can also download the program updates yourself, from the website technical support developer. The moment you registered your software for the first time, you received a username and password to enter Personal Area... Log in using them. Go to the 1C: Taxpayer updates page and download the missing updates. If the period of access to updates has expired, purchase the update package for the period you need by adding it to the "Cart". After confirming payment, you will be able to download the required files. Run the downloaded exe files, wait for the updates to install and restart your computer.

« Taxpayer LE " is the official software developed by the tax service of the Russian Federation. Its main purpose is to facilitate the process of preparing documents for submission to FTS and automate this process. The software helps to prepare both electronic versions of documents, exporting them to the formats of office programs, and to print reports.

To get started, you need to make sure that you have the latest version of the program installed. Since the requirements for the reporting of individuals and legal entities to the Federal Tax Service are constantly changing, amendments or additional columns are made to the sample documents. If the version " Taxpayer " is out of date, the documents you have prepared may not comply with applicable law.

The program facilitates the process of preparing documents, due to the fact that it initially enters information about the organization into the database and saves them. At launch, you are asked to fill in information about the taxpayer, the recipient's IFRS, select the reporting form and period. All completed information will be saved, making it easier to fill out declarations in the future. You can easily make changes if needed.

Documents that are prepared using "Legal entity taxpayer" 4.61:

- VAT information

- All types of personal income tax reports

- Insurance calculations

- Registration of CCP

- Application of ESHN, STS

- Taxpayer accounting

- Notification of the OFR, etc.

The software is fully translated into Russian and is compatible with OS Windows XP or higher. On our website you can download the latest version of the program "Legal entity taxpayer" 4.61 from 2019. Files are downloaded from the official website of the Federal Tax Service.

Screenshots

Taxpayer of Legal Entities - a program that helps entrepreneurs, businessmen, as well as individuals in the formation of reporting to the tax authorities. The program is supplied free of charge and can be used by any individual or legal entity.

Regardless of the version of the Legal Entity Taxpayer, its installation on HDD computer takes place in several stages, which we will fully describe on the version that is current at the moment.

In order to use the program, first of all, you need to download it (relevance - mid-JANUARY 2019):

More likely to come soon! Bookmark this page to always have the latest update!

STEP 1

Run the program by double clicking on the downloaded installation file.

Most likely, Windows will ask you if you agree to open the executable file, press yes or ok.

Read it carefully, put an end to the menu item

“I accept the terms license agreement”And the“ Next ”button below.

Accordingly, if you do not accept the terms of the license of the program, the installation will not continue.

STEP 2

Installation type. Here you are offered to choose to install the full version, or the client part of the program. If this is your first time installing Legal Entity Taxpayer, it is better to select “full installation” and click “next”.

STEP 3

Destination folder

At this stage of the installation, you are asked to choose a place where the program will be located. We do not recommend storing important work files on the same disk as the system. In most cases, Windows is located on drive C, so it is better to choose another drive to install the program, of course, if available.

This is done so that if Windows loses its functionality (and this happens), the working files of the program are not damaged and remain safe on another disk.

If you do not have another logical drive on your computer besides C, you will have to select a folder there, or leave the default path: C: \ Taxpayer YL \

Click on next.

STEP 4

Everything is simple here: we press “Install” and the program performs manipulations without your participation, installing the files into the folder selected at the previous stage.

STEP 5

After the files are successfully installed in the directory, a window should appear as in the picture above. This means that the installation was successful and the program is ready to run.

You can check the box with the description “Run the program” if you want to use it immediately after installation.

Click “done”. The installation of the Legal Lease Taxpayer program is now complete.

If you minimize all active windows, you will see the program shortcut on the desktop:

Now, to use the program, you need to double-click on it and the program will open.

Setting up Legal entity taxpayer after launch

As soon as the program is launched for the first time on your device, it will offer to configure itself. A window will pop up called “Add taxpayer”:

Here you need to make a choice from the presented fields, according to what reports you are going to generate: for an entrepreneur, legal entity or physical. A choice of Foreign Organization and Separate Subdivision is also available.

We will outline the further steps for the Individual Entrepreneur, since most of our visitors are sole proprietors.

So, by choosing “Individual Entrepreneur” and clicking “OK”, we are offered to set up IP data for use in further reports and documents.

Fill in the fields in any order. A sample of their filling is shown on the screenshot.

We select line 05: Sole proprietor not making payments to individuals.

Note! Each square surrounded by a dotted line is a function button. You can click on it, an additional window will open, which is designed to select the information entered into the corresponding field. It is available for almost every field, except for “when and by whom the passport was issued”, “address of residence” and “place of birth”.

After you have filled in all the required fields, click “Apply” and “OK”.

Remember: you can edit the entered information at any time by simply clicking on the person registered in the program, whose name is in the upper right corner under the menu:

This completes the installation and initial setup Taxpayer completed. Be sure to save the page so you can easily find it when needed.